Facebook announced yesterday that it will be shuttering Partner Categories: the product that allows third-party data providers to supplement advertisers with targeting information directly through Facebook.

In the announcement, Facebook noted that "this is common industry practice," but will still shutter the product to "help improve people’s privacy on Facebook."

Source: Facebook

For Facebook and marketers alike, the announcement is what ProPublica reporter Julia Angwin called "a big deal." Here's what's going on -- and why it matters.

Where Facebook Advertisers Get Their Data

Prior to these recent changes, advertisers on Facebook had a few primary sources of user data that they could use for targeting purposes, including data that Facebook itself has from what users provide on their profiles, as well as their activity on the network. It's not entirely unlike what's available in your downloadable Facebook data archive file, which I wrote about here.

That data could be used in combination with other sources of information that the advertiser might have on its own, like email contacts or survey responses.

Finally, there are the third-party data providers, which are the ones Facebook has severed ties with. These companies possess and provide advertisers with data that are often based on non-social-media activities, like shopping history and income -- which is part of what Angwin and her team discovered when ProPublica started investigating the breadth of Facebook user data in 2016.

We also found that 600 of the 29,000 categories Facebook offered to advertisers were from data brokers. They were extremely specific and often financial, such as income between $100k and $125k or frequent shopper at dollar stores. /6https://t.co/S4Yo2nEa1T

— Julia Angwin (@JuliaAngwin) March 29, 2018

The data from these providers are often synthesized in tandem with information that Facebook has from user profiles, helping to match (or target) promoted content to the most relevant audiences. It's a powerful combination that could be at least partially responsible for Facebook's growth as a valuable advertising platform -- to the point where 98% of its 2017 global revenue was rooted in advertising.

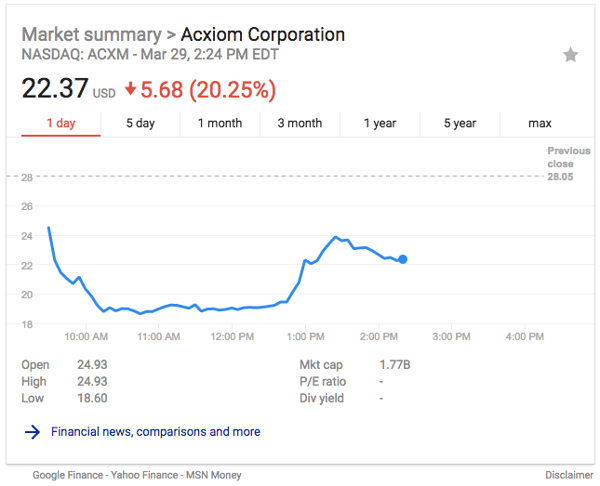

And again, as Facebook said itself, these practices are not limited to Facebook advertisers, and are frequently promoted as a value-add by some of the larger data providers involved, like Experian and Acxiom. The latter calls it a "data package" that can help advertisers "accurately identify relevant audiences for all of your media campaigns."

It's no secret, then, that providing these services is a source of revenue for the data providers, too. According to the Wall Street Journal, Acxiom stands to lose $25 million in fiscal 2019 revenue and profit. And while it seems possible for advertisers to still independently enlist these third-party services, a barrier to access is now in place that was previously removed by direct data availability through Facebook.

Acxiom's stock price at 2:25 PM EDT March 29, within 24 hours of Facebook's announcement. Source: Google

What This Means for Marketers

But how much do advertisers stand to lose from these changes? Well, that depends who you ask. When I first tweeted this news after it broke last night, one of my followers suggested that he'd be losing a major source of information for his work.

Of course that’s the targeting foundation of all my current campaigns...

— Scott DeRuyter (@SDMad) March 29, 2018

The extent of the setback to marketers and advertisers also depends on the industry -- those who depend on a consumer's shopping habits and history, for example, could potentially lose out by not having access to detailed, third-party data on it.

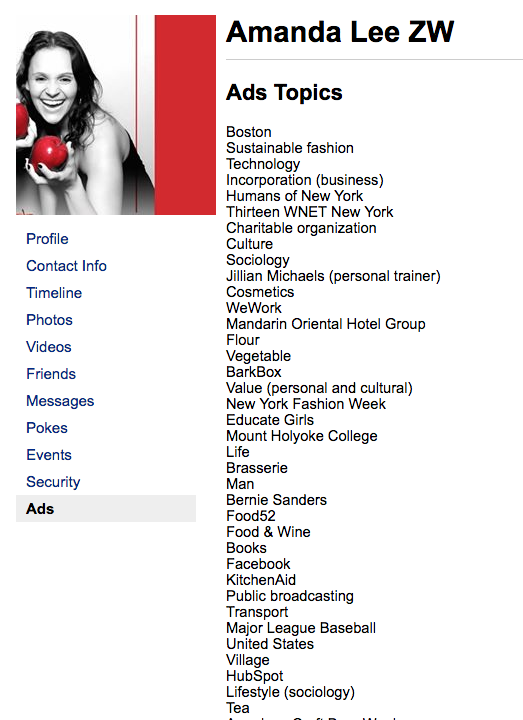

But keep in mind that Facebook has quite the cache of user data entirely on its own. Remember that downloadable data file I alluded to earlier? Have another look.

The file shows that Facebook possesses a decent -- if not confusing -- amount of information on users' interests and activities. And where that data really comes into play for most advertisers is in its own ad-targeting platform.

That doesn't necessarily reveal individual user data, but it allows advertisers to customize promoted content audiences based on it -- interests, location, and so forth. Here's a page from my own file with some of the "interest" data Facebook uses to help target ads:

That data isn't exactly minuscule, and some advertisers could still be able to effectively reach audiences with it. "The reality is that Facebook’s targeting tools are so powerful," says Henry Franco, HubSpot's Social Campaign Strategy Associate, "some analysts think this change won’t make much of a difference in overall targeting capabilities."

Why Is Facebook Doing This?

Here's the thing about the user data in Facebook's possession (the kind that's used within its own targeting tools): Most people don't really want advertisers to have direct access to that information in a way that attaches it to specific people.

Instead, it seems, the widespread preference is for it to be anonymous and general enough that, for example, an advertiser can target Boston-based women in a certain age bracket who are interested in KitchenAid and BarkBox -- but not be able to do is know who, specifically, the women are within that targeted audience.

That's part of what got Facebook into this situation in the first place. Previous policies allowed third parties like app developers and academics to access user data for things like research purposes -- but prohibited them from transferring that information to others. But when it came to light that one app developer may have violated that policy by supplementing data analytics firm Cambridge Analytica with that information, the social network began making changes to the availability of and policy clarity around user data.

The suspension of direct access within Facebook to data from third-party providers is just the latest in a series of changes. "More than anything else, it looks like Facebook is trying to clean up its act in the wake of the recent data scandal involving Cambridge Analytica," says Franco. "While this change might be a little reactive, it’s a step in the right direction for a company of Facebook’s stature."

Facebook isn't alone in its recent onslaught of privacy and other policy changes. Companies ranging from Apple to Venmo have also been notifying users of modifications, at least partly in response to the heightened scrutiny of Facebook and some of its Big Tech counterparts. (In addition to Facebook CEO Mark Zuckerberg, chief executives from Twitter and Google have also been asked to testify before Congress in the wake of these ongoing events.)

Wow, Apple with the timely shade in OS update form. pic.twitter.com/YL34i4DKnn

— M.G. Siegler (@mgsiegler) March 29, 2018

But it may not be entirely in response to this particular situation. On May 25, which is less than two months away, the General Data Privacy Regulation (GDPR) comes into force and will impact the way organizations obtain, store, manage or process the personal data of EU citizens -- which some believe is also behind these recent policy changes and notifications.

But all things considered, this is likely not the last policy change expected from Facebook. And as the story continues to unfold, I'll be monitoring it. Questions? Feel free to weigh in on Twitter.

from Marketing https://ift.tt/2IgGiKZ

via IFTTT

Comments

Post a Comment